Building a balanced investment portfolio can sound a bit intimidating, especially if you’re just starting out or don’t have much to invest.

I’ve seen a lot of folks pour hours of effort into stock picking, chasing trends, or even letting their emotions take the wheel, and then wonder why their results fall short.

The real kicker?

Most investors stumble not because they’re lazy, but because their portfolio lacks proper balance.

When all your money sits with one stock, one sector, or even just one type of investment, a market hiccup can do major damage.

It doesn’t matter if that investment seems rock solid; sudden changes happen more than most people expect.

Spreading things out stops your whole portfolio from sinking when one piece goes south.

When people talk about a “balanced portfolio,” the idea isn’t to make things complicated.

It’s about mixing different types of investments, so your money keeps working for you over the long haul while dodging unnecessary risk.

In this guide, I’m going to break down what a balanced portfolio actually is, why it matters for real growth, and how you can build one at any budget.

I’ll walk through each core asset type, show you how to pick the right mix, avoid common traps, and keep your plan on track with simple, actionable steps.

Whether you’re a total beginner or have been investing for years, there’s something here to help you grow your wealth with confidence.

What Is a Balanced Investment Portfolio?

In plain English, a balanced portfolio is just a smart way of spreading your money across different kinds of investments.

Instead of betting it all on one thing (like stocks), you give your cash different jobs. Some of your money’s out there looking for big growth (that’s things like stocks), some is focused on steady, dependable returns (like bonds or cash), and maybe a small portion is in riskier stuff that could pay off in the future (like real estate or crypto).

Balance is a bigger deal than simply chasing high returns. Super aggressive portfolios can hit big wins in the short term, but just as often, they can crash back to zero when markets take a nosedive.

A balanced portfolio doesn’t try to game the system; it tries to ride out the highs and lows without losing sleep every time the market takes a wild swing.

For folks thinking about long-term goals like retirement, a new house, or funding a child’s education, a balanced approach is really important for keeping growth steady over the years.

Short-term investing is often about quick wins, often with much higher risk. Long-term investing, using balance, lets you use time to your advantage.

Compounding does its magic best when you avoid big, sudden drops. In other words, balance isn’t boring. It’s a strategy that gives your money the best shot to grow with way less stress.

Recommended Reading: Beginner’s Guide To Investing In Crypto: What You Should Know First

Why Long-Term Growth Requires Portfolio Balance

Markets go up and down, sometimes for reasons nobody can predict.

If you’ve ever watched the news and seen stocks bounce like a yo-yo, you know what I mean.

One year a certain sector or country is on top, and the next year it’s facing tough times. If all your investments live in that one spot, those ups and downs hit your money hard.

That’s where balance steps in.

When one part of your portfolio has a rough year, another might be holding steady or even climbing. Think of it like not putting all your eggs in one basket.

This mix keeps your overall savings from swinging wildly with every headline or market blip, making it much easier to stay the course over the long run.

Time is another big advantage.

The longer you stay invested, the more powerful diversification and compounding become. By covering different types of assets, your portfolio works across all sorts of market conditions, letting you weather storms and benefit from recoveries.

History shows that, over time, diversified (balanced) investors are much more likely to grow wealth than those who take big, concentrated shots, hoping for overnight success.

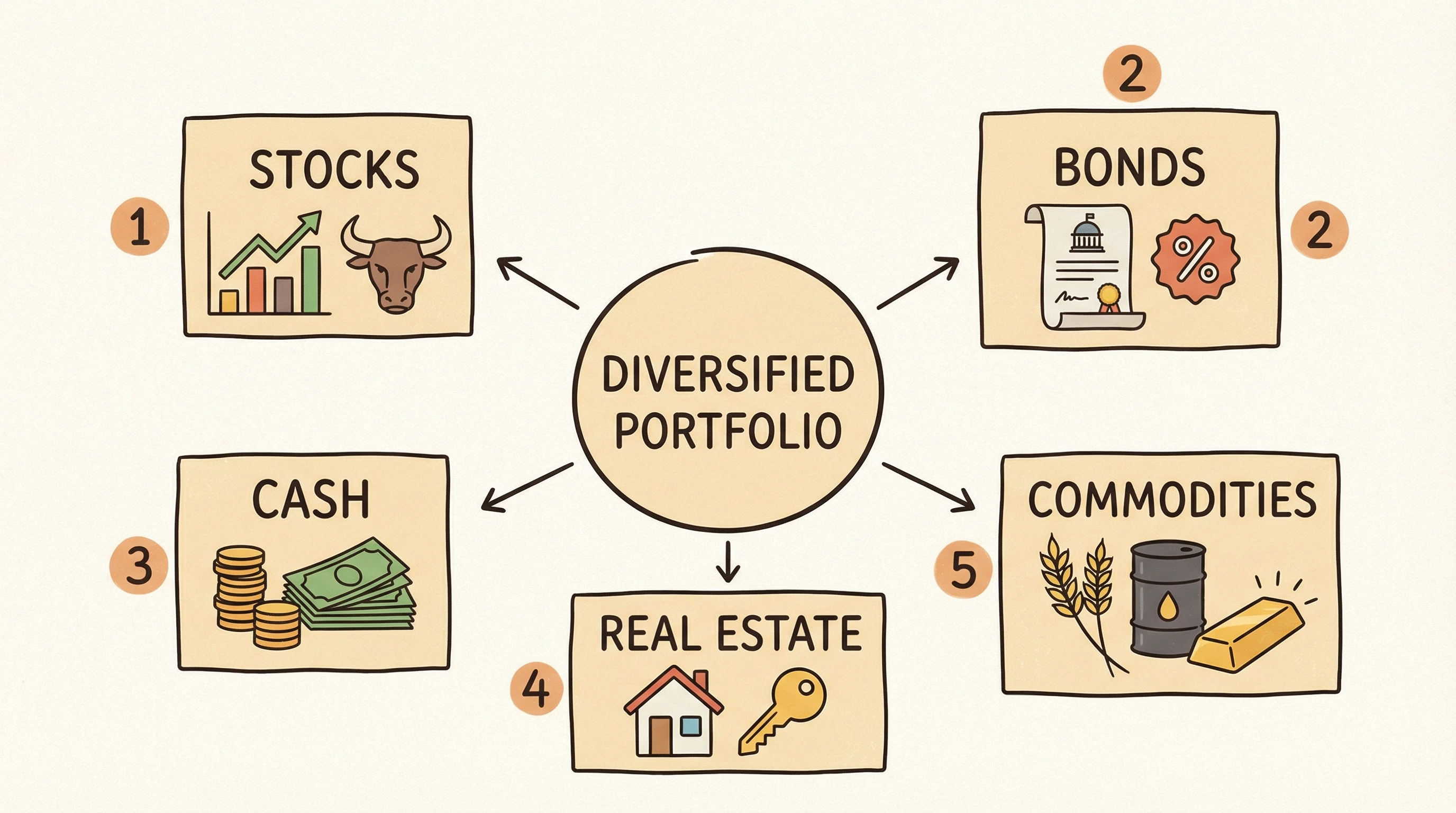

Core Asset Classes Every Balanced Portfolio Uses

Every well-balanced portfolio has a mix of investments called asset classes.

Each one does a specific job.

Some drive growth, some provide stability, and others help you stay liquid or grab new opportunities.

Here’s a breakdown of the core types and why they matter.

- Stocks (Growth Engine): These are the shares you own in actual companies. Over decades, stocks have been a top driver for growing wealth, especially when you’re thinking long term. Index funds, a way to buy a whole basket of stocks at once, can make it super easy for beginners. They track the overall market and tend to have lower fees than picking individual stocks. Individual stocks can work too, but only if you’re ready to do your homework and don’t mind the extra risk.

- Bonds (Stability Layer): Bonds are like IOUs you give to governments or companies; they pay you back with interest. Bonds usually don’t climb as fast as stocks, but they’re steadier. If stocks drop, bonds can help even things out, which is especially helpful during downturns or if you’re closer to needing your money soon. Bonds play an important role in smoothing out volatility and dampening losses.

- Cash & Cash Equivalents: This bucket includes savings accounts, money market funds, and short-term CDs. Cash isn’t about making money, but about being ready when the unexpected hits (like a job loss) or an opportunity pops up (such as buying stocks when they’re “on sale”). Liquidity is another big plus; you can quickly access this money without selling other investments at a bad time.

- Alternative Assets (Optional): For folks looking to further mix in some variety, a small slice of the portfolio can go into alternatives like real estate, commodities (like gold), or even crypto. Real estate (either directly or through REITs) adds income and can move differently from stocks. Commodities like gold sometimes hold value when stocks swoon. Crypto is a whole different beast, high reward, even higher risk, so only put in what you’re prepared to lose.

How to Choose the Right Asset Allocation

Picking the right mix (“allocation”) comes down to a few key things: your age, your comfort with risk, and when you’ll actually need the money.

The whole point is to put together a plan that makes sense for your situation, not just copy what’s trending on the internet that week.

Most people use age-based guidelines to start. The classic rule of thumb is “take 100 minus your age, and invest that percent in stocks, with the rest in bonds.”

If you’re 30, you might have 70% in stocks and 30% in bonds and cash. If you’re 60, maybe it’s closer to 40% stocks, 60% bonds, and cash for more stability as retirement gets closer. These rules are just starting points, though. They don’t know your personal risk tolerance.

Your risk tolerance basically means how comfortable you are with seeing your investments drop in value (even for a while).

If you panic and sell the moment you see red numbers, a more conservative allocation will help you actually stick to your plan.

If you’re able to ride it out without losing sleep, you may lean more toward stocks for extra growth.

Time horizon matters most. Money you won’t need for 10+ years can usually handle more swings than cash you’re planning to use soon.

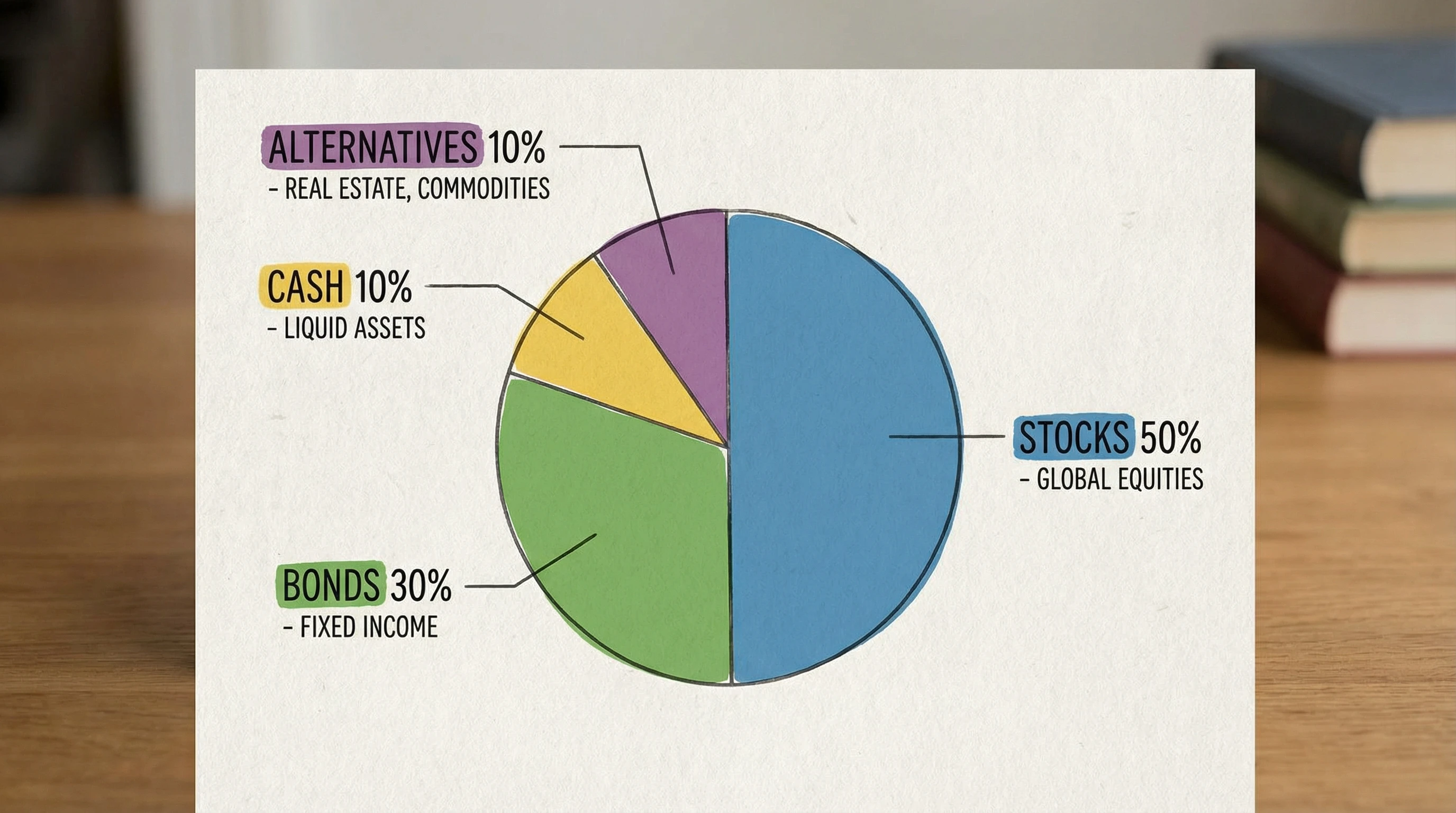

Here are a few example allocations to give you an idea:

- Conservative: 30% stocks, 60% bonds, 10% cash

- Balanced: 60% stocks, 35% bonds, 5% cash

- Growth focused: 80% stocks, 15% bonds, 5% cash

No single allocation works for everyone.

The key is to match your investments to your own goals and personality. And no matter what, being consistent is more valuable than constantly trying to time the perfect moment to buy or sell.

Diversification Explained (Without the Jargon)

Diversification is just a fancy word for “not keeping all your eggs in one basket.”

It’s one of the easiest and most effective ways to cut your risk.

By owning a mix of different assets and different types of stocks and bonds within those categories, you make sure one bad bet doesn’t wipe out your savings.

There are a few different ways to mix in some variety:

- Domestic vs. International: Don’t let your investments stay stuck in just one country. International stocks and bonds move differently from U.S. ones. If you invest globally, you’re less exposed to troubles in your home market and get a piece of growth from all over the world.

- Sector Diversity: Within stocks, owning companies from all kinds of industries (tech, health care, energy, etc.) is really important. If tech stocks hit a rough patch, those losses can be cushioned by gains in something like utilities or consumer goods.

- Geographic Diversity: This is about making sure your investments aren’t all dependent on the fortunes of one currency or political system. If you only own bonds from a single country, a downturn there could hit you harder than you expect.

Funds like broad index ETFs and mutual funds do most of the heavy lifting here, all in a single purchase.

Even with a small budget, you can end up owning hundreds or even thousands of pieces of different companies and sectors, spreading out risk for just a few bucks a month.

How Often Should You Rebalance Your Portfolio?

Rebalancing simply means adjusting your investments back to your original plan.

Over time, some parts of your portfolio may grow faster than others.

If stocks soar, they might go from 60% of your mix to 70% just by riding the wave. That exposes you to more risk than you originally planned.

Most people pick a schedule.

Once a year is plenty for many, although some prefer to check in every quarter. Others rebalance only when the mix gets more than a certain amount off target (for example, more than 5% from the plan).

There’s no perfect schedule, but the biggest impact comes from just doing it consistently rather than overthinking the exact timing.

Some folks over-rebalance, fiddling with their portfolio every month in reaction to the news or market swings.

That’s a fast track to racking up unnecessary fees and possibly making things worse. Others avoid rebalancing out of fear, letting their portfolios get out of shape.

If you have trouble staying calm during market swings, setting your plan on autopilot and only rebalancing by the calendar can help ignore the noise and stick to your plan.

Common Mistakes to Avoid When Building a Portfolio

- Overinvesting in one asset: Going “all in” on one stock, one trendy sector, or even one country sounds daring, but usually backfires. It’s pretty risky, even if you’re convinced you found the next big thing.

- Chasing hot trends: Jumping into the investments that everyone’s buzzing about is tempting, but you rarely hear about those same investments after the hype cools, and if you buy in late, you often buy high and sell low.

- Ignoring fees: Small fees can add up and quietly eat away at your returns, especially when using pricier funds or active managers. Index funds and ETFs usually keep these costs low.

- Emotional buying and selling: Trying to outsmart the market every time headlines change causes way more harm than just sticking to a steady plan. Fear and greed make for lousy investing buddies.

- Lack of a clear plan: If you don’t know what your investing goals are, it’s easy to wander (or even give up when things get tough). Setting a clear target and checking up on your progress each year makes a world of difference.

- Neglecting to keep learning: Markets change, and new tools appear all the time. Regularly reading trusted resources or seeking updated information can help you avoid outdated strategies and spot new opportunities.

Long-Term Growth vs Short-Term Speculation

Investors who stick with a long-term, diversified plan tend to come out ahead of the folks chasing the latest “can’t miss” trends.

When you invest with the idea that you’re growing wealth slowly over decades, not betting on lottery tickets, you let compounding do the heavy lifting.

The danger with speculation is that hot stocks, meme coins, or buzzy funds can make headlines, but most people buy after the surge and sell in panic on the way down.

Meanwhile, steady, long-term investors watch their portfolios ride out those storms and keep growing through all kinds of markets.

Patience really pays in investing.

There will always be moments that test your nerves: big drops, scary headlines, periods where nothing seems to move. Sticking to your plan during those times isn’t always easy, but it gives your investments time to recover and grow.

The key is to put your money to work as early as possible and keep it invested as consistently as you can.

Don’t underestimate the value of time—years and decades are your strongest allies. Over the long run, slow but steady contributions add up faster than you think.

Can Beginners Build a Balanced Portfolio?

Absolutely.

Starting with even a small amount is better than waiting forever for the “perfect moment” or a giant lump sum.

Most brokerages now let you buy fractional shares of index funds and ETFs, which means you can invest with as little as a few dollars at a time.

There are a ton of beginner-friendly tools out there now, too.

Target date funds automatically pick and adjust your mix based on your timeline. Robo advisors (automated investing apps) ask you a few questions and build a balanced, diversified portfolio for you based on your goals and risk tolerance.

Even a basic DIY approach, picking two or three broad funds and investing on a regular schedule, can work just fine.

Trying to chase complicated strategies or time the market often backfires.

Focus on learning the basics, getting your account set up, and developing the habit of investing regularly.

Your future self will thank you for keeping it simple and steady. Plus, the sooner you start, the sooner you benefit from compounding growth.

Final Thoughts: Building Wealth Is a System, Not a Shortcut

Growing wealth through a balanced investment portfolio isn’t about quick wins or finding the “magic” stock.

It’s about putting together a plan, sticking with it, and letting time and compounding do their best work.

Balance smooths out the bumps and helps you sleep better at night, while consistency turns small, steady steps into real results.

If you really want to speed things up on your path, boosting your income alongside your investing can give a boost to your financial progress. Investing works even better when your cash flow is growing, so you can invest more and reach your goals faster.

If you’d like a step by step, beginner friendly way to build online income in your spare time, on top of your investing, check out my recommended training platform. It comes with clear video lessons, practical tools, and a supportive community focused on long term, real world results.

- Step-by-step online business training

- Beginner-friendly tools and support

- Long-term wealth mindset

See my #1 recommended training platform here

Wishing you tons of success on your new investing journey.

Let us know where you plan on getting started.

We would love to hear from you.

Regards and Take Care

Roopesh