Compound interest is often called the secret ingredient for growing savings, but a lot of people only have a loose idea of what it actually means.

I used to assume compound interest was just a fancy way of saying “extra money added over time,” but there’s more to it. It’s honestly a lot more powerful than most people realize. If you’re looking to make your money work harder, understanding this concept is pretty much non-negotiable.

If you’ve got savings sitting in a bank account, or you’re thinking about starting to save, compound interest is the reason your balance gets bigger.

Sometimes, it even grows faster than you’d expect, depending on a few key details. In this guide, I’m going to walk you through everything you need to know about how compound interest works for savings.

I’ll break down the concept in plain language, show you why it matters, compare simple and compound interest, and run through straightforward examples so you can see the difference for yourself.

You’ll also get insider tips on how to put compound interest to work for your goals, avoid common mistakes, and maximize your savings with real-world strategies. Ready to see how far your money can go? Let’s dive in.

What Is Compound Interest? (Simple Explanation)

If you’ve ever wondered, “How does compound interest work for savings?” here’s the scoop: Compound interest means you’re earning interest not just on the money you save but also on the interest your money has already earned.

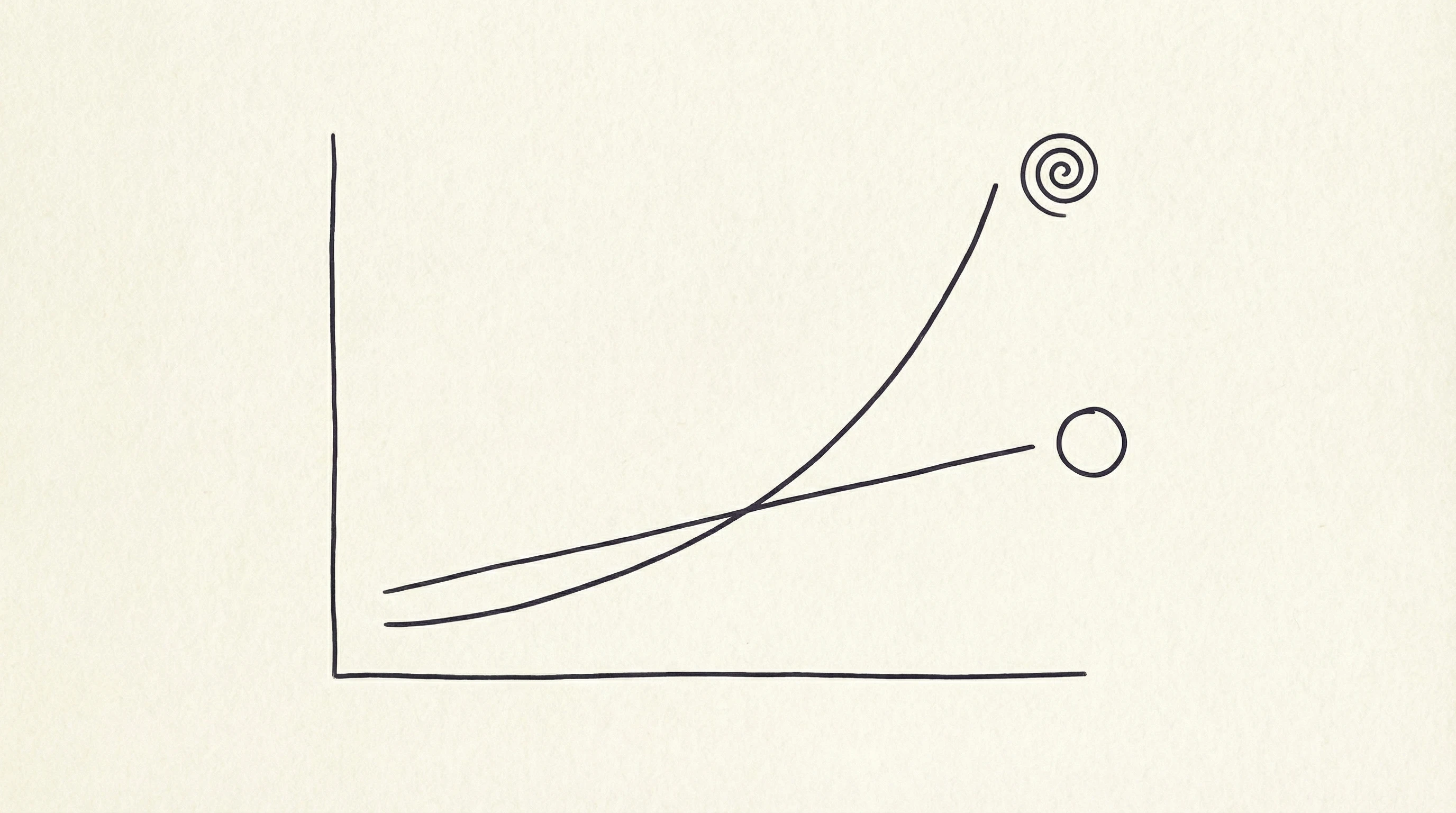

Your balance doesn’t just grow a little bit each year. Instead, it grows at an increasing rate as time goes on.

For example, say you put $1,000 in a savings account.

With simple interest, you earn the same amount every year, based just on your original deposit. With compound interest, you earn money on your original deposit, plus on any interest you’ve already made. Over time, the difference adds up more than you might think. It’s what some people call “interest on interest,” and it’s the reason compound savings accounts can really snowball, especially if you leave your money alone to grow.

The power of compound interest just gets bigger the longer you let your money ride.

That’s why people say, “the best time to start saving was yesterday. The next best time is today.” The earlier you start, the more compounding can go to work for you.

How Compound Interest Works for Savings Accounts

Savings accounts are one of the most popular places to see compound interest in action.

Here’s how banks typically calculate it:

- Deposit: You start by putting money (your “principal”) into a savings account.

- Interest Rate: The bank pays you a certain interest rate, usually shown as Annual Percentage Yield (APY).

- Compounding Frequency: The bank decides how often to add earned interest to your account, whether once a year, monthly, or even daily.

- Balance Grows: Every time interest gets added, it becomes part of your principal. Next time, interest is calculated on this larger amount.

The frequency of compounding (how often the bank adds interest) actually has a bigger impact than most people think.

Let’s say you can choose between a bank that compounds interest every year and one that compounds monthly. If the rates are the same, the one that compounds more often is going to help your balance grow faster.

Some online banks even offer daily compounding, which gives you a tiny boost every single day. Over the years, that can mean extra dollars in your pocket.

Time is a super important factor, too.

Even if the interest rate isn’t sky high, leaving your savings in place for a long period lets compounding ramp up in a big way.

Time does a lot of the heavy lifting here, so starting soon and staying patient pays off even more than chasing super high rates or trying to time the market.

Simple Interest vs Compound Interest

It’s easy to get tripped up by these two terms.

Here’s a quick rundown on how they play out for savings:

- Simple Interest: You only earn interest on your original deposit (the principal), not on the interest your account generated earlier.

- Compound Interest: You earn interest on both your principal and all the interest you’ve already earned. This means your interest also earns interest, which supercharges your growth over time.

To see the impact, picture this: You put $1,000 in a savings account with a 5% annual interest rate.

- With simple interest: You’d get $50 every year ($1,000 x 5%). After five years, your total would be $1,250.

- With compound interest (compounded yearly): You’d earn more with each passing year. By year five, you’d have about $1,276.

$26 might not sound like much, but stretch this out to 20, 30, or 40 years—and throw in some regular deposits—and the difference really adds up.

That’s why savings accounts that pay compound interest usually help your money grow faster.

Recommended Reading: How To Manage Credit Card Debt Effectively On A Tight Budget

Key Factors That Affect Compound Interest Growth

Interest Rate

A higher interest rate means your savings will grow faster, even if the boost seems small at first.

An extra 1% might not feel like a big deal right now, but over years, it can mean hundreds or even thousands more in your pocket.

I always recommend comparing rates when picking a savings account. It’s worth checking out online banks, which sometimes offer higher yields than brickandmortar spots.

Time

This is the superpower behind compound interest. The earlier you start saving, the more compounding will work for you.

Even small amounts saved now can outpace much bigger deposits made years later. I’ve seen friends who started saving in their 20s come out way ahead of folks who started later with higher amounts.

Compounding Frequency

Banks might compound interest daily, monthly, quarterly, or annually. More frequent compounding means your interest can start earning interest sooner. If you’re comparing savings accounts, look for those that compound at least monthly for better longterm growth.

Regular Contributions

Adding a little money to your account each month makes a huge difference. Those monthly deposits each start earning their own interest, and soon you’ve got multiple “streams” of compounding happening at once.

This is a simple way to speed up your savings growth, even if your initial deposit wasn’t huge.

Example: How Compound Interest Grows Savings Over Time

Seeing the numbers makes everything a lot clearer. Here are two examples to show how compound interest can help your savings pile up over the years:

Lump Sum Example

Let’s say you put $5,000 into a compound interest savings account that pays 4% per year, compounded monthly.

No further deposits.

- After 10 years: About $7,444

- After 20 years: Around $11,123

Your money more than doubles in two decades, just by letting compound interest do its thing. No extra work needed.

Regular Monthly Contributions Example

Instead of a lump sum, imagine you start with $100, and add $100 every month to a compound interest account with a 4% interest rate, compounded monthly.

- After 10 years: About $14,800

- After 20 years: Over $36,500

It’s all about patience, not just big deposits. The most effective trick is sticking with it and letting your money grow steadily, month after month.

I’ve found that getting in the habit of consistent saving beats trying to time it perfectly or waiting until you can “afford” to stash away larger amounts.

Where Can You Earn Compound Interest on Savings?

If you want to make use of compound interest, there are a few types of accounts worth checking out:

- Savings Accounts: Most standard savings accounts at banks and credit unions offer compound interest, though the rates can vary a lot.

- Money Market Accounts: These typically pay a bit more interest than standard savings accounts, often with the same compounding perks.

- Fixed Deposits (Certificates of Deposit): You lock your money up for a set time in exchange for a guaranteed interest rate. Compounding happens here too, just on a fixed schedule.

- Tax-Free Savings Accounts/Roth IRAs: In some countries, special savings or retirement accounts let your balance grow with compound interest, and your earnings might even be taxfree. Always check the fine print for restrictions or minimums.

It’s really important to know that higher yields sometimes mean higher risk. Most savings products from major banks are pretty safe, but if you’re promised skyhigh rates, do your homework to make sure your money is protected.

Common Misunderstandings About Compound Interest

- “Compound interest will make me rich quickly.” This one pops up everywhere. The honest truth is: Compounding is kind of slow at first. It takes some patience and discipline. The rewards come later, when your money starts to snowball on itself.

- Withdrawing early doesn’t matter.” Actually, pulling out your savings early means you miss out on the best part of the compounding effect. Typically, the last few years are where you see the biggest jumps in your balance.

- “Interest always beats inflation.” Not all savings accounts keep up with inflation, especially during low-rate periods. It’s worth keeping an eye on current rates and considering options that offer better returns so your money keeps its value over time.

Basically, compounding works best when you’re patient and avoid touching your money unless you absolutely need to.

How to Maximize Compound Interest on Your Savings

- Start as early as possible. The earlier you start saving, the more time compound interest has to grow your money. Even if it’s just a small amount, start today if you can.

- Save consistently, even small amounts. Setting up automatic transfers helps keep you on track, even if your monthly deposit is just $20 or $50.

- Avoid unnecessary withdrawals. The key to getting the most from compounding is letting your savings grow untouched for as long as possible.

- Reinvest all interest earned. Make sure your interest is added back into your account, not sent out in cash. This lets your interest start earning even more every compounding period.

- Choose accounts with strong rates and frequent compounding. Shop around for accounts that offer a combination of good rates and monthly (or even daily) compounding. Compare options online before settling on a bank.

I always tell friends to review their savings options at least once a year.

Rates might change, or a new account could offer a better compounding schedule. That little bit of effort can help keep your money growing at a healthy pace.

Compound Interest vs Growing Income

Compound interest truly is a strong tool for letting your savings grow by itself, but it’s worth having realistic expectations.

The process works best for growing your existing money steadily—not for turning $100 into a million overnight. That’s why people often use compound interest as just one piece of their entire financial plan, along with increasing income through work, investments, or side gigs.

If you’re chasing big financial goals, think about combining regular saving habits with ways to give a boost to your earnings.

More income means more cash you can put into compound interest accounts, and that’s where things really start to pick up. Take the slow and steady path, and stay on the lookout for opportunities to step up your earning power, too.

FREE Masterclass Bundle: The Next Step to Financial Momentum

If you’re ready to make your money go further, don’t stop at saving. I’m sharing my FREE masterclass bundle to help you build real financial momentum:

- 🎓 Access to four top-rated money masterclass videos (real stories, actionable tips!)

- 📕 A simple beginner’s guide to earning online, perfect for anyone looking to add new income streams

No spam or pushy sales, just tools to help you start growing and protecting what you’ve already saved. [Click here to grab your free bundle and get started]

Wishing you everything of the best in your savings endeavours.

Regards

Roopesh