Credit card debt has a way of sneaking up on even the most organized people. The thing about it is that it feels so easy and convenient in the moment; just swipe and go. But before you know it, all those purchases add up, and the balance seems stuck even after months of payments.

The interest keeps piling on, the minimums barely move the needle, and stress starts creeping in every time the statement arrives in your inbox.

If you’re working with a tight budget, credit card debt can feel like it’s robbing you of any financial breathing room. The good news: with the right plan, you can chip away at your balances and finally see real progress.

In this guide, I’ll walk you through practical steps for managing credit card debt, even when extra cash is hard to find.

From understanding how the debt stacks up, to making smarter payments, to avoiding common traps—everything you need to start clearing that debt mountain is covered.

Ready to get a handle on your credit card debt? Here’s everything you’ll learn:

- Why credit card debt is so tough to escape (and how to break free)

- How to list, organize, and truly understand what you owe

- Strategies that actually work for getting your balances down

- Setting up a budget that helps you get out of debt without giving up everything you enjoy

- Tactics to cut down interest and fees, so more money goes toward your debt

- What pitfalls trip up most people, and how you can steer clear

- How to speed up your progress by boosting your income

- Answers to the big questions about timelines, consolidation, and long-term success

Why Credit Card Debt Is Tough to Escape

Credit card debt works differently from other loans.

Most credit cards use something called revolving credit, which just means you have a set limit, and as you pay off what you’ve spent, you can use that credit again and again.

Sounds pretty handy, right?

Until the interest charges pile up. Credit card interest rates often run way higher than car loans, mortgages, or even personal loans.

Minimum payments look manageable at first; that’s where the trap is. They’re designed mostly to cover the interest, with just a small bit chipping away at your actual balance.

If you only pay the minimum, you could spend years paying off the debt and end up shelling out way more in interest than you paid for the item in the first place.

It’s easy to fall into the habit of just making the minimum payment when cash is tight.

But with high interest rates, every month your balance barely drops—even though you’re sending in money.

Worse, if you keep using the card while you still have a balance, your debt can quietly keep rising.

That’s why getting clear on how credit card debt grows, and why it feels like such a heavy weight, is the first step to breaking out.

Get Clear: Listing Out Your Credit Card Debt

Nothing changes until you know exactly what you’re dealing with.

Start by grabbing all your credit card statements or logging into your online accounts.

For each card, jot down these basics:

- Name of the card

- Current balance

- Interest rate (APR)

- Minimum monthly payment

I always recommend making a simple table; it doesn’t need to be fancy, a notebook or spreadsheet works.

Tally up the balances and the minimums.

This is your true starting point, not a guess, not what you wish it were.

Seeing the whole picture is sometimes a shock, but it puts you back in the driver’s seat.

When you know what you owe and where, you can spot the largest balances or highest rates and track your progress from month to month.

That clarity is powerful, even when the numbers are bigger than you hoped.

Stop the Bleeding: Make Sure the Debt Isn’t Growing

Before any strategy can work, you want to make sure your debt isn’t quietly getting worse. That means hitting pause on any new, nonessential spending with your cards.

If you’ve built a habit of using credit cards for groceries or gas, it’s time to make a change, at least until you’ve got your debt under control.

If you’re tempted to keep swiping, put your cards somewhere hard to reach. Some people freeze them in a block of ice (literally), or just tuck them away and delete the card numbers from online shopping accounts.

The less accessible, the less likely you’ll impulse-swipe.

It’s really important to know the difference between using cards for true emergencies (like a car repair so you can get to work) versus everyday spending that could be handled with your actual budget or a small emergency fund.

When you’re paying off debt, try to lean on savings—even if it’s just a little—rather than adding more to your credit cards.

You’re building a new habit, and behavior changes (not just a new spreadsheet) are what break the cycle.

Pick a Proven Plan: Debt Payoff Strategies That Work

Once you’re ready to attack your balances, there are a couple of time-tested strategies that work, especially when you’re starting with a tight budget.

You don’t need to invent anything new here.

Here’s how these strategies stack up:

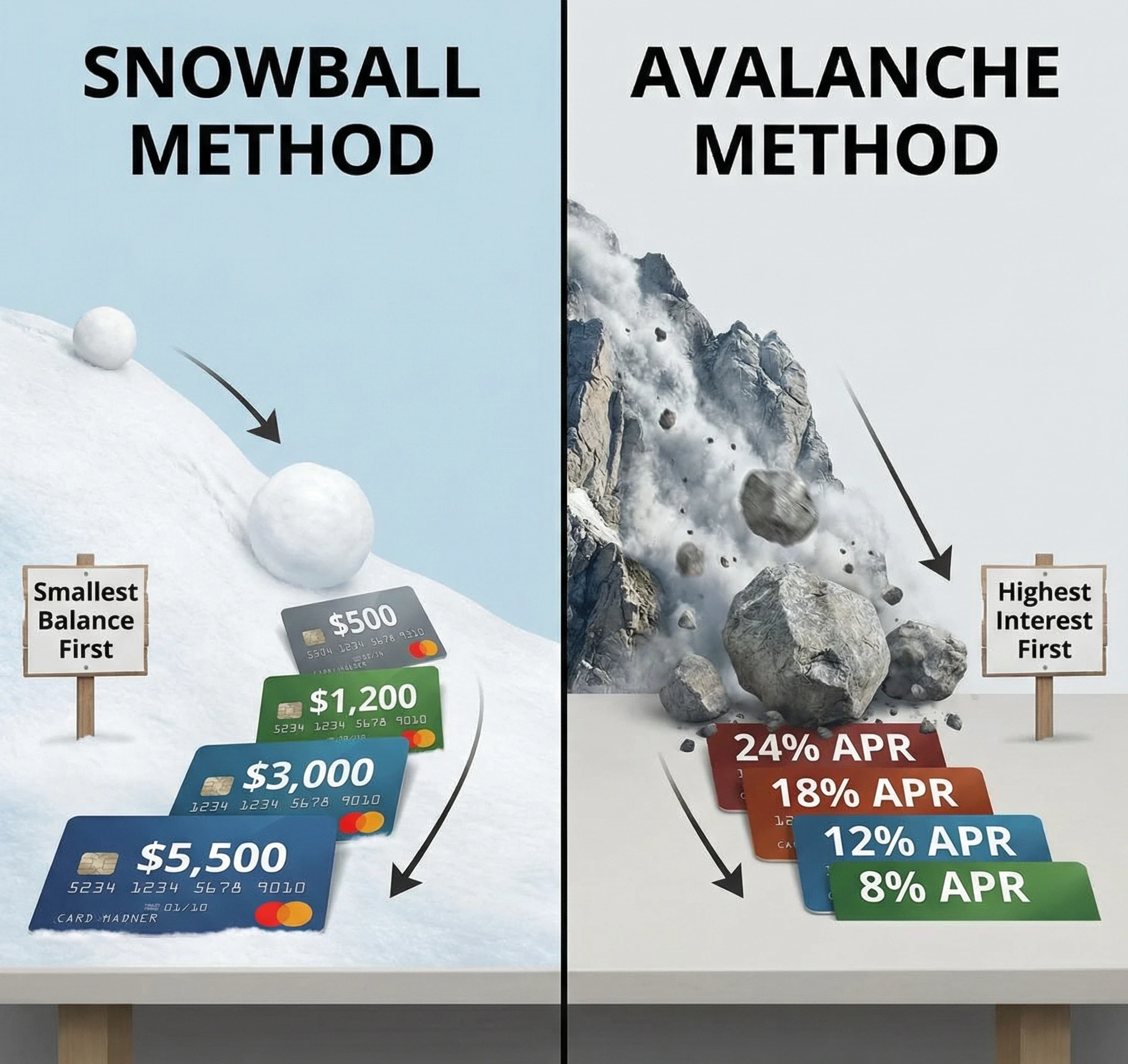

Snowball Method: Build Motivation Fast

If you need some quick psychological wins, the snowball method is a simple approach.

Take your full list of cards and order them from the smallest balance to the largest, regardless of interest rate.

Pay the minimum on every card, but put any extra money toward the card with the smallest balance.

Once that’s gone, move on to the next smallest card with all the money you were using for the first one.

This gives you that hit of accomplishment quickly, which helps a lot if you get overwhelmed easily or want to see zero balances fast.

Every win motivates you to keep going.

Avalanche Method: Save the Most on Interest

If you’re less about quick wins and more about saving the most money, try the avalanche method.

This time, order your cards by interest rate, highest to lowest.

Pay minimums everywhere, throw every extra dollar at the highest-interest card, and once that’s paid, tackle the next-highest rate.

This way, you cut down the amount you pay in interest, which means you get out of debt a bit faster (and cheaper).

This method works best for people who can stay motivated by numbers instead of crossing whole cards off their list fast.

Balance Transfer: Pause the Interest (If It Makes Sense)

If your credit score is okay, you might get offers for a balance transfer card; one of those deals that promises 0% interest for a set period if you move your debt over.

This can help, but only if you’re disciplined and read the fine print.

Here are a few things to be careful with:

- Check how long the promo rate lasts. After that, the regular rate can be just as high as what you’re paying now.

- Watch for transfer fees. Usually, these are 3-5% of the balance you move. Make sure any savings aren’t eaten up by fees.

- Don’t use the new card for purchases; treat it as debt only. New charges usually don’t get the promo rate.

If you’re already struggling to make payments or think you might rack up new debt, skip the balance transfer.

Focus on one of the other two methods above, so you don’t dig a deeper hole.

Budgeting to Pay Off Debt on a Tight Income

Budgeting isn’t about restriction; it’s a way to figure out how much you really have available to put toward debt.

When you’re on a tight budget, this is especially helpful because you want every extra dollar to do as much work as possible.

Here’s how to keep it realistic:

- List your fixed expenses (rent, utilities, basic groceries, minimum loan payments). These don’t change much month to month.

- List your variable expenses (eating out, entertainment, shopping, extras).

Now, see where you can trim even a little.

Maybe it’s downgrading a streaming service, packing more lunches, or skipping takeout once a week.

Anything you save goes straight to the debt.

I like using simple budgeting apps on my phone; they track every expense and can remind me when I’m getting close to my limits.

The main thing is to assign a set amount every month to debt payoff before spending on anything else.

This keeps your debt snowball, or avalanche, moving even when you feel stretched.

How to Cut Down Interest and Fees

Saving on interest and fees means more of your hard-earned money goes to crushing that balance.

A few moves that can really add up:

- Call your card company and ask for a lower interest rate. If you’ve got a solid payment history, they might agree. Even a percent or two lower shaves money off the total payoff.

- Avoid late fees. Missing a payment even by a day can cost you. Set up autopay for at least the minimum so you’re never late, even if you forget.

- Stay under your limit. Some cards add fees for going over; plus, it can hurt your credit. If you’re close to maxed out, curb spending right away.

Little tweaks, like setting up reminders or putting due dates in your phone’s calendar, go a long way.

Over time, saving even $10–20 per month in fees or interest gives you more cash for actual debt reduction.

Add Fuel to the Fire: Boosting Your Debt Repayment Power

Certain spending cuts are quick wins; maybe you swap a big-brand cell plan for a discount provider, but budgets can only be trimmed so much, especially if you’re already stretched thin.

Eventually, paying off debt gets easier if you can bring in a bit of extra income. I know that sounds tough, but even small side gigs, a few hours of freelancing, or selling stuff you no longer need can give your debt payoff plan a healthy boost.

This isn’t about working all hours and burning out, but exploring practical ways to speed up your ride to zero debt.

These days, there are more options than ever: online surveys, pet sitting, odd jobs, driving for delivery apps, or even offering simple skills online.

Sometimes, a little creativity in finding ways to bring in $50–100 more each month can cut six months or more off your repayment schedule.

More on this in a sec, but keep this idea parked in the back of your mind as you go.

Recommended Reading: How to Understand Your Paycheck Deductions Easily

Common Credit Card Debt Mistakes and How to Stay Clear

It’s easy to fall into one or two traps when trying to pay off credit card debt, especially with so many companies promising the “easy way out.”

Here are some things I’ve seen (and personally experienced) that can slow down your progress:

- Paying only the minimum, month after month. The balance barely moves, and you rack up loads of interest.

- Closing paid off, cards too soon. This can lower your credit score, especially if you still have other balances or do not have a lot of credit history. Leave them open, but don’t use them.

- Ignoring your statements. Hidden fees, rate increases, or fraudulent charges can sneak in easily if you’re not watching.

- Trusting quickfix promises. Anyone who says you can wipe out debt overnight, without cost or impact, is probably scamming you or hiding something in the fine print.

- Using new credit to pay off old credit. Swapping debt around usually just delays the hard work.

Avoid these common mistakes, and the progress you make, even if it’s small each month, will mean a lot more in the long run.

How Long Will It Take? Figuring Out Your Debt-Free Timeline

Everybody wants to know how long it’ll actually take to be credit card debt-free.

Truth is, it depends on three things: the total you owe, the interest rate, and how much you’re paying each month.

Here’s a simple example:

- If you owe $4,000 at 20% APR and pay only the $100 minimum, you could be stuck for over five years and pay $2,700 in interest!

- Double your payment to $200, and you could pay it off in about two years, with less than $900 in interest.

That’s why pushing even a little extra toward your debt, month after month, makes a huge difference.

Missing a month isn’t the end of the world; just pick back up the next month. Consistency and patience pay off way more than aiming for perfection.

Should You Manage Debt Yourself or Look Into Consolidation?

Managing your own credit card debt is usually the least expensive and most straightforward option; you control the pace and there aren’t any extra fees added on by a service.

But if you’ve tried for a while and can’t make headway, or you’re juggling so many minimums that you can’t see a way out, there are other paths to check out:

- Debt consolidation means rolling all your credit card balances into one new loan (usually at a lower rate), so you only have one payment to track. This can help, but not if the new interest rate isn’t actually better, or you rack up new debt before paying off the old.

- Debt counseling involves working with a nonprofit credit counselor who can help you make a budget or structure a payoff plan. These programs can sometimes negotiate lower rates or payments. Check reviews or accreditation (like through the NFCC) before working with any agency.

Consolidation or counseling can help if you’ve really exhausted all other options, but tread carefully.

Sometimes, these moves make things worse, especially if you end up borrowing more money or paying high fees.

Always do your homework, and make sure whoever you work with is reputable and clearly explains all your options.

Take Your Progress Further: Free Resources to Help You Grow

Managing credit card debt is an achievement in itself, but what if you could not only get out of debt but also start building a steady, new income to give a boost to your financial future?

I’ve put together a bundle that’s totally free for readers:

- Access to four masterclass videos, packed with insights from entrepreneurs who’ve built high online incomes (normally $499)

- A beginner-friendly affiliate marketing guide to kickstart your own side hustle

This isn’t just about scraping by—it’s about giving yourself the tools and inspiration to break out of the paycheck-to-paycheck cycle. If you want to see what’s inside and take your money game up a notch, check out the opt-in below.

Getting a grip on credit card debt with a small budget isn’t easy, but progress is always possible.

Each month you pay down the balance, you win back control, peace of mind, and future possibilities.

Start wherever you are right now, even if it’s just with one small change. Every step matters.

Wishing you everything of the best.

Good Luck!

Regards

Roopesh