Ever felt like your paycheck loses weight between leaving your employer and landing in your account?

I remember the first time I looked at a real payslip and nearly spilled my coffee at how different the numbers were. Some deductions were familiar, but most just looked like a secret code.

Making sense of those deduction lines is a big step in taking charge of your financial life. Here’s how to understand paycheck deductions without the headaches.

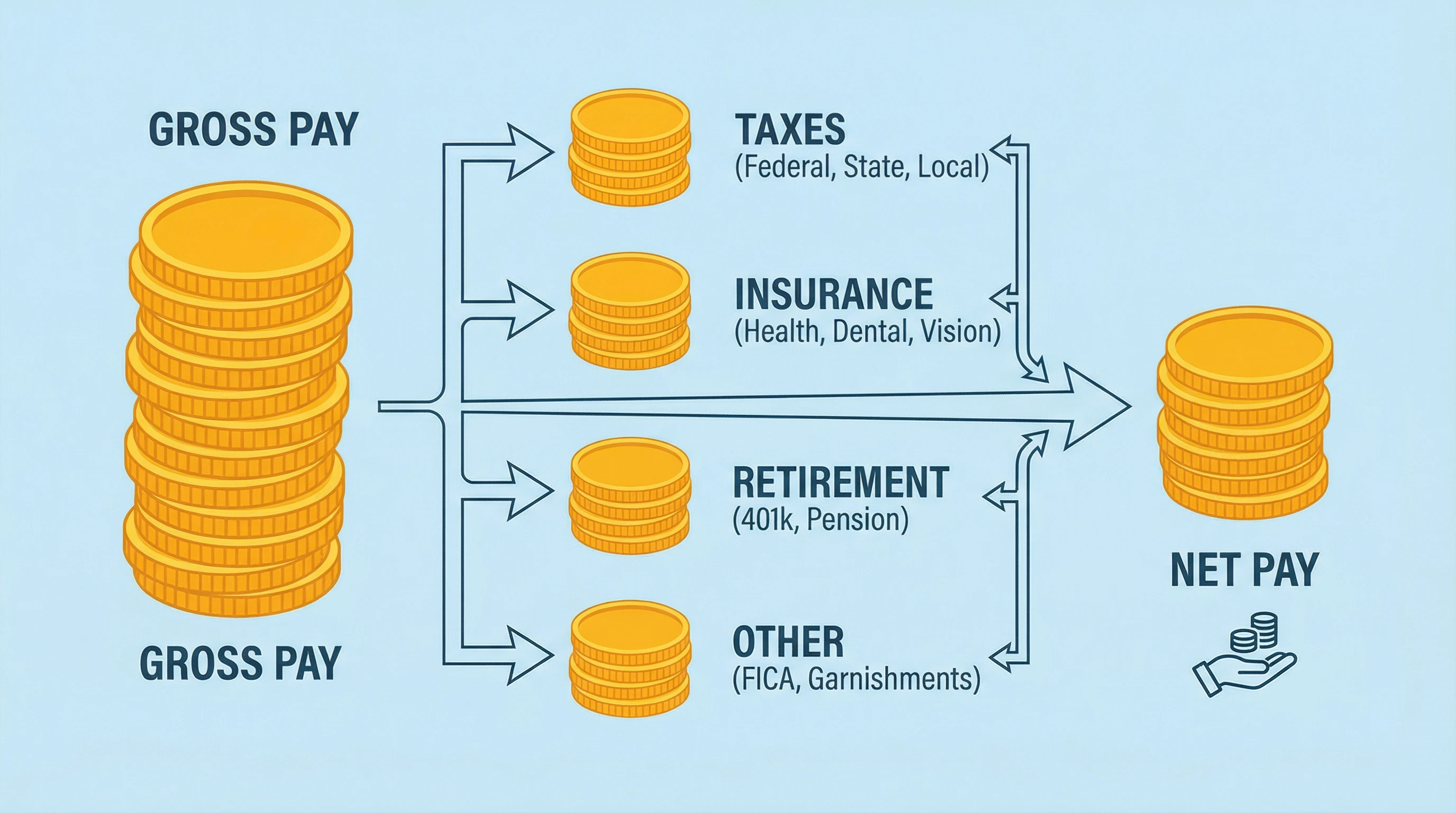

Gross Pay vs. Net Pay: What’s Really Going On?

Let’s start with the basics. Gross pay is the big number—your full pay before anything’s taken out.

If you’re on a salary, this is usually your annual salary divided by twelve.

Worked hourly? Gross pay is all your hours multiplied by your hourly rate, before taxes or benefits.

Net pay (sometimes called take-home pay) is the money that actually lands in your bank account after all the deductions are subtracted. It’s way more realistic for budgeting because that’s what you can actually spend or save.

Knowing the difference isn’t just helpful for dodging end-of-month surprises. It helps with budgeting, keeps you ready for tax season, and gives you the info you need to make plans.

Whether it’s saving, spending, or hunting for a raise, understanding your pay is key.

Getting to Know Your Payslip

Payslips come in all shapes and formats, whether printed or digital.

But they all have some pretty standard sections:

- Employee info: Name, ID, pay period

- Gross pay: Your full pay before deductions

- Deductions: Every item subtracted from gross pay (like taxes, retirement, and other benefits)

- Net pay: The final amount you actually get

Some slips split out allowances (travel, lunch, cell phone) or mark certain benefits as pretax or posttax.

The more you know about each line, the less likely you’ll be caught off guard. Payslips might also display things like leave balances or overtime, which impact your monthly totals.

Mandatory Deduction Types: The Non-Negotiables

Every payslip has some deductions you can’t avoid; these are required by law. Here’s what those usually look like:

PAYE (Income Tax)

Pay-As-You-Earn, or PAYE, means your employer takes money out of each paycheck for your taxes and sends it to the tax authorities.

Instead of getting billed a lump sum at tax time, you pay in little chunks all year. The actual amount depends on tax brackets and your total gross pay. If you earn more, you pay a higher percentage. If you have deductions or credits, your tax rate can come down.

Unemployment Insurance (UIF)

In countries like South Africa, UIF provides some income if you lose your job. Usually, your employer deducts 1% of your salary and matches it. It’s a helpful backup if things ever go sideways at work.

Skills Development Levy (SDL)

This one is more behind the scenes. In some places, like South Africa, your employer pays SDL to help fund training and upskilling across industries.

It doesn’t come out of your net pay, but it’s good to know why it might appear on your payslip. SDL supports the workforce as a whole by contributing to industry skill growth.

Other Deductions: What Else You’ll Find

Retirement, Pension, and Provident Fund Contributions

A lot of jobs come with retirement benefits.

Your employer might automatically deduct a percentage of your pay to fund your pension or provident fund. Sometimes this is required, and sometimes it’s optional. Or you can choose to put in extra.

Either way, it’s savings for your future, but it does mean less cash in your pocket today. Some plans let you increase or decrease contributions at certain times of the year.

Medical Aid or Health Insurance

If your employer offers health insurance or medical aid, and you participate, your share usually comes out of your paycheck.

The exact amount depends on your plan—single, family, lower-cost, or premium options. Some employers subsidize these costs, which can be a great benefit.

Voluntary Deductions

Union dues, gym memberships, savings clubs, loan repayments, or even donations. Any extra deductions that you’ve signed up for fit in this category.

These will always need your written agreement, so you should recognize every voluntary deduction on your payslip. If something looks unfamiliar, always check in with HR.

Are These Deductions Allowed?

Employers can only deduct money for a few specific reasons:

- The law says so; statutory deductions like PAYE, UIF, or court-ordered payments

- You gave clear written permission

- A court or government order (like a garnishee order for debt)

Anything shady or “unapproved” on your slip is a red flag.

Always ask HR or payroll if something doesn’t look right because it’s your money. Sometimes, honest mistakes happen in payroll systems, so checking your payslip is a good habit.

Recommended Reading: Key Terms In Personal Finance: 30 Essential Terms Every Beginner Must Know

Why Is My Net Pay So Much Lower?

Figuring out how you end up with your net pay is simpler if you stick to this formula:

Gross Pay – (Total Deductions) = Net Pay

More deductions mean less net pay. Some common reasons your paycheck is lower than you hoped for include:

- Income tax (PAYE)

- UIF or unemployment insurance

- Pension, provident, or other retirement contributions

- Medical aid or health insurance

- Loan repayments, advances, or other voluntary deductions

You might also see one-off deductions, like uniform costs or fines, but these should always come with a heads-up or written agreement.

Employers should never just deduct amounts without your knowledge.

Payslip Line-by-Line: How to Read Every Item

Here’s a quick breakdown of the main sections you’ll spot on a typical payslip, plus what they mean:

- Basic Salary: Your agreed-upon pay for the normal month’s work. This is before anything else is added or subtracted.

- Allowances: Extra amounts for travel, meals, communications, or housing. Usually, these are taxable unless clearly marked as nontaxable, like some travel allowances within certain limits.

- Statutory Deductions: PAYE, UIF, retirement fund contributions (mandatory stuff)

- Voluntary Benefits: Medical aid, group savings, voluntary extra retirement payments

- Other Deductions: Unions, loans, garnishee orders, or payroll purchases

- Net Pay: The final deposit amount; what you can actually spend

Sometimes, payslips list both employer and employee contributions, especially for retirement or insurance.

Remember, only your side comes out of your check, but the total shows how much is going toward your savings or benefits overall.

If you ever spot entries labeled “adjustment,” “reversal,” or other unusual one-offs, checking with payroll clears things up quickly.

Mistakes can happen, and it’s always easier to sort them sooner.

Simple Examples: How Deductions Add Up

Here’s how deduction math might look in real life:

Example 1: Entry-Level Monthly Salary

Let’s say you earn R10,000 (gross) a month:

- PAYE: R700

- UIF: R100

- Pension deduction: R800

- Medical aid: R500

Total deductions = R2,100; Net Pay = R10,000 – R2,100 = R7,900

Example 2: Mid-Level Salary With Higher Tax

If your gross salary is R25,000 per month:

- PAYE (higher bracket): R4,000

- UIF: R100

- Pension: R2,000

- Medical aid: R1,200

Total deductions = R7,300; Net Pay = R25,000 – R7,300 = R17,700

It’s easy to see how your tax band and voluntary contributions change what actually lands in your account. Comparing your payslip before and after a raise helps spot exactly where changes happen.

Common Mistakes When Reading Deductions

- Thinking that your gross salary and net salary are the same. (I made this mistake in my first job. Not fun.)

- Forgetting about voluntary deductions like medical aid or retirement add-ons. These chip away at net pay.

- Missing the difference between statutory deductions (required) and things you agreed to (voluntary). Very different rules apply!

The more you double-check your slip and track what’s agreed upon, the better off your monthly finances will be. If something changes, always look for an explanation.

Should You Adjust Your Deductions?

Mistakes can happen.

Even the best HR teams get things mixed up sometimes.

If you notice a deduction you didn’t sign up for, or that looks different from what’s in your contract, flag it right away. Payroll can usually walk you through a payslip and sort things out without any fuss.

If you have some slack in your budget, increasing contributions to retirement or savings benefits your future self.

On the other hand, if your paycheck’s too tight for comfort, you might have options to reduce voluntary deductions—speak with HR and get advice first. Some companies even let you pause or change certain deductions at set times during the year.

Holding onto older payslips makes it very easy to spot changes month to month, especially if you get a raise, switch your medical plan, or tweak your benefits. Reviewing a year’s worth of tax returns at tax time can also help double-check that all the deductions line up correctly.

Frequently Asked Questions

What are statutory vs. voluntary deductions?

Statutory deductions are required by law—like tax, UIF, or garnishee orders. Voluntary deductions are optional and only kick in if you’ve agreed in writing, such as by joining a medical aid or saving for extra retirement.

Why does my salary change month to month?

There can be several reasons: overtime, commission, unpaid days off, changes in tax tables, or temporary allowances or deductions (like advances or one-off costs). Comparing payslips and asking payroll for details helps track any mix-ups or shifts.

How do I get a full breakdown of my deductions?

Most employers will give you a detailed payslip every pay period. If any line isn’t clear, don’t hesitate to ask HR or payroll for a breakdown. They’re used to these questions. You have a right to clear info on your money.

Extra Help: Master Your Money (Free Resource)

If you’re ready to get serious about your financial freedom, not just reading payslips but planning, saving, and building new income streams, I’ve put together a handy free resource just for you:

- 📌 4 powerful masterclass videos by 7-figure earners (Value $499)

- 📌 Affiliate marketing guide for beginners

These are designed to give you real-world ways to build your side income by learning the skills of an online entrepreneur.

Worth checking out if you are ready to invest in yourself, and change the trajectory of your life.. Grab your free resources here.

Understanding your paycheck deductions puts you in the driver’s seat.

The more you know, the better you can plan and catch surprises before they mess with your finances. Stay curious, ask questions, and your money will work harder for you.